Rum Trends To Watch in 2026

6 Rum trends to watch in 2026

Most spirits categories are having to battle for market share and Rum is no different. And it’s safe to say the Rum market has eased off a little since 2024. Even so, forecasts offer plenty of room for optimism, with the global market estimated to increase from $17.25 billion to almost $28 billion by 2033 - a CAGR of 5.5%. (Source: Market Data Forecast).

This blog will take you through the six trends set to add momentum to this rebound over the coming year - and beyond.

This isn't just about growth. It's about transformation. The trends shaping 2026 represent fundamental shifts that look set to endure. Understanding these changing patterns in consumption is essential for any Rum brand wishing to thrive in an increasingly sophisticated marketplace.

Trend #1: Premium positioning = the new normal

The statistics tell a compelling story. The premium Rum market is forecast to expand from $5.25 billion in 2024 to $8.45 billion by 2033, representing a hefty CAGR of 5.6% (Source: The Spirits Business).

This shift may differ across key markets, but the drivers remain consistent. North America leads the way with 35% of the total revenues, thanks in part to a growing interest in craft and aged Rums. This is especially the case among the 25-44 age group, who are increasingly seeking high-quality, craft spirits with authentic narratives and distinctive production techniques.

German consumers are also on the lookout for unique flavour profiles and authentic craftsmanship, a development that is encouraging brands to innovate and offer new and more diverse varieties. Premium Rum is also gaining momentum in the United Kingdom: a younger demographic seeks innovative flavours and craft options, while the rise of cocktail culture is also playing a part.

🔎 Strategic insight: Premium and craft Rums are gaining traction, fuelled by rising disposable incomes and a global push towards authentic experiences. We are seeing consumers willing to pay more for quality and exclusivity. Aged Rums, especially single origin and cask-finished varieties, are becoming symbols of sophistication among connoisseurs.

See how we can help you develop your own premium Rum brand

Trend #2: Flavour innovation = new consumer segments

Dark Rum may command a dominant share of the global market. But look out for exponential growth in spiced and flavoured variants, which represents a parallel trend that brands cannot afford to ignore.

Spiced Rums remain particularly dominant in Europe

The versatility of spiced Rums allows producers to target multiple market segments simultaneously, from entry-level drinkers discovering accessible flavours to experienced drinkers exploring complex spice combinations in premium expressions. Some researchers expect the global spiced Rum market alone to hit $9.67 billion by 2030.

Flavoured variants are also on the up

We expect demand for vanilla, tropical and spiced flavoured Rums to continue accelerating. The rise of mixology and cocktail culture once again a significant driver of growth. Consumers increasingly understand the way different flavour profiles enhance both neat sipping and cocktail experiences.

The innovation behind this trend extends far beyond the mere addition of flavour. Some brands are experimenting with botanical infusions, exotic fruit combinations, and innovative ageing techniques that incorporate various spices and aromatics. This kind of creativity is not only expanding Rum's appeal across the spectrum of taste preferences, but also reshaping consumer expectations.

🔎 Strategic insight. Flavoured no longer means inferior. Some brands are positioning complex spiced expressions alongside their aged offerings to win over adventurous newcomers as well as experienced drinkers searching for unique experiences.

Learn more about the spiced Rum market

Trend #3: Sustainable creds = sustainable advantage

Modern consumers don't simply focus on the drink in their glass. These days, they are also interested in the journey it took to get there. That means sustainability and ethical sourcing have evolved into essential brand requirements, particularly among environmentally aware millennials and Gen Z audiences. Expect 2026 to be no different.

Minimum impact. Maximum transparency.

Distilleries are increasingly taking steps to minimise their environmental impact across every link in the value chain, from traceable sourcing, Bonscuro certifications and Fair Trade sugarcane to carbon-reduced operations and recyclable packaging.

This trend can represent both a challenge and a big opportunity. Brands that embrace sustainability and clearly communicate these credentials could likely build a lasting competitive advantage.

The certification trend is accelerating

An increasing number of producers and suppliers are responding to this trend by obtaining official sustainability certifications. (E&A Scheer maintains Bonsucro, Fairtrade, and Organic certification for example.) Third-party standards bring credibility to brand claims, providing consumers with the transparency and the assurance they are looking for.

🔎 Strategic insight: Sustainability isn't a cost. It's a competitive advantage that helps brands to attract environmentally aware drinkers and standout in an increasingly crowded marketplace.

Source your sustainable Rum blend with E&A Scheer

Trend #4: Cocktail culture = increased consumption

The global renaissance in cocktail culture should continue to accelerate over 2026 – and Rum is perfectly placed to benefit. The versatility of Rum in both simple and complex drinks makes it a staple in bars and households alike.

Rum's serves as a key ingredient in a wide range of classic cocktails such as Mojitos, Daiquiris and Piña Coladas, not to mention contemporary craft cocktails.

With bartenders favouring Rum's unmatched versatility, the powerful ripple effects of this professional endorsement is starting to influence consumer behaviour at home as well as in bars.

Democratising cocktail culture

That is why the home bartending revolution deserves special recognition. Consumers are experimenting with daiquiris, mai tais, and Rum punches at home, resulting in a mixology movement that democratises cocktail culture.

Today, sophisticated drinks are accessible to anyone with basic equipment and quality ingredients.

🔎 Strategic insight: We are increasingly seeing brands working together with bars and mixologists - both amateur and professional - through education and product positioning, to capture the momentum of the growing cocktail culture.

Learn more about the global cocktail market

Trend #5: Bespoke partnerships = premium opportunities

Modern drinkers are increasingly on the lookout for unique products, exceptional quality, and authentic storytelling.

In response, many hotels, restaurants and retailers are now developing their own unique Rums to enhance brand exclusivity and drive loyalty.

This momentum continues to accelerate worldwide: 2024 figures showed US private-label alcohol sales surged by 12% over the previous 12 months and by 23% compared to 2022 figures. (Source: SPINS)

In fact, private label Rum is emerging as a standout performer within the industry, challenging some of the industry’s household names.

Private label brands currently hold around 9% of the market (Source: Market.us Media) with Spiced Rums and Premium Aged Rums set to become the fastest growing styles.

🔎 Strategic insight: One of the attractions of private labelling is its exclusivity, with consumers valuing products they can't find elsewhere. This helps to build loyalty whilst reinforcing brand differentiation.

Learn more about creating your own private label Rum

Trend #6: RTD innovation = health-conscious consumers

As consumers continue to shift their interest towards more innovative products, we suggest keeping a close eye on Ready-to-drink (RTD) products.

The category already offers explosive growth potential, with sales forecast to hit $40 billion by 2027 across 10 key markets. (Source: IWSR RTDs Strategic Study 2023)

The health-conscious revolution is reshaping product development

Growth will be driven by cocktail culture, long drinks and premium-price products. At the same time, the general trend towards healthier lifestyles is shaping a growing preference for drinks with lower alcohol content, fewer calories, and less sugar. Many RTD cocktails are being formulated to align with these health-conscious choices.

Blending quality with convenience

RTDs are also gaining traction on the tailwinds of cocktail culture. By capturing the innovative flavours and premium quality of an authentic cocktail experience in an accessible ready-to-go format, RTDs appeals to a segment that prioritises convenience without compromising quality.

🔎 Strategic insight: Successful RTD strategies think beyond mere convenience to address the full spectrum of modern consumer priorities, such as health, quality, authenticity, and experience.

The revolution is accelerating

These six Rum trends for 2026 won’t be operating in isolation. Instead, view them as interconnected forces that are reshaping the Rum landscape right now.

The most successful brands will recognise these trends represent fundamental market shifts, rather than temporary blips.

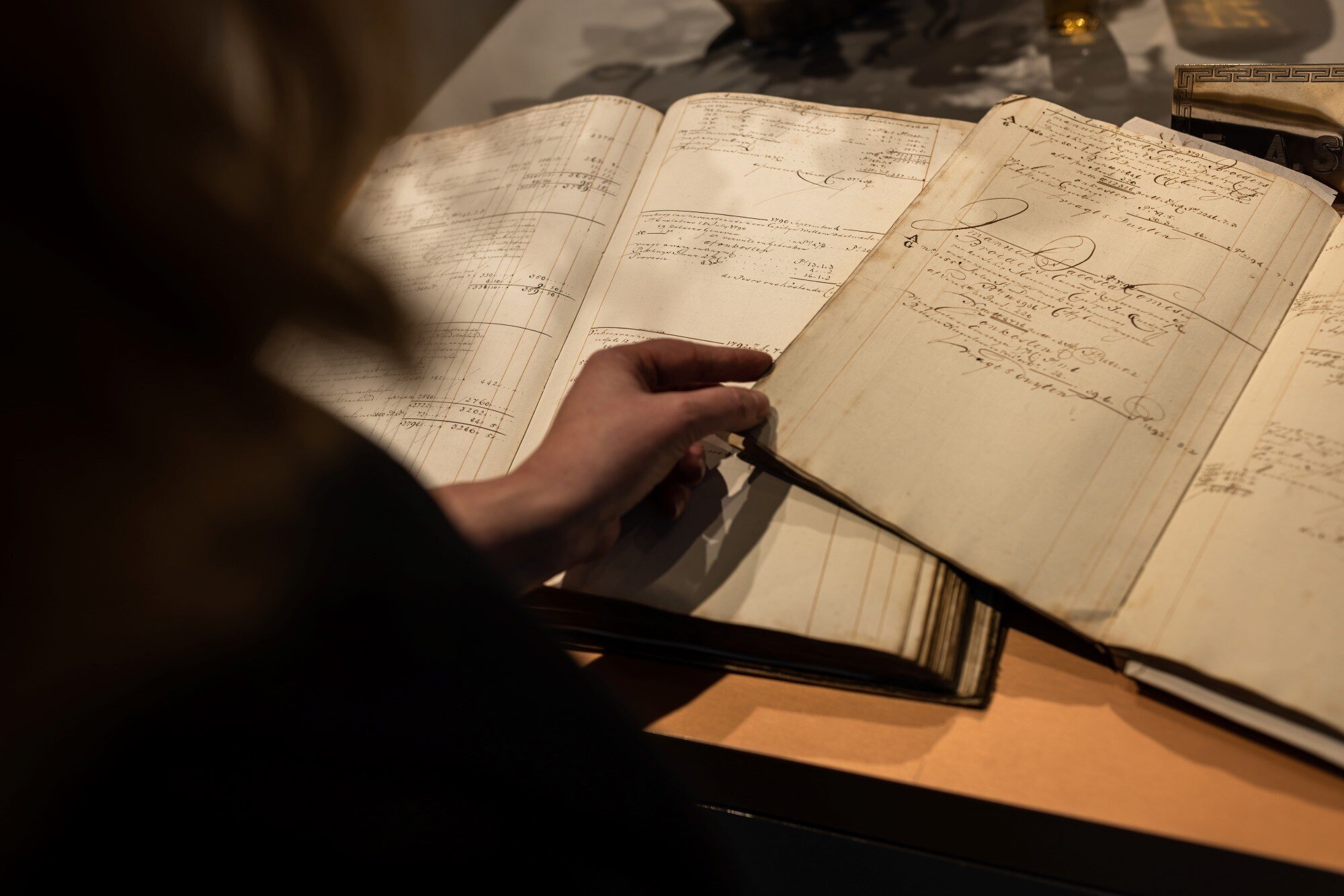

E&A Scheer offers the expertise to help you navigate and lead this revolution. For three centuries, we have developed bespoke Rums to position and maintain our customers at the forefront of the market.

As a trusted supplier and expert blender, we can draw upon an unrivalled inventory and a global network of distilleries and logistical partners to make sure you’re ready for 2026 and beyond.

Rum Blending Tool

Browse the latest resources & industry insights to learn more about our companies and the Rum world in general.