The European Rum Market: Sales Trends & Future Outlook

Inside the European Rum Revolution: sales trends and future outlook

European Rum market: an overview

From the supermarket aisles of London to the cocktail bars of Berlin, the European Rum market is experiencing a remarkable renaissance.

With a current value exceeding $5 billion and projected to grow at a CAGR of 4.4% until 2030*, Europe has emerged as a critical market for Rum brands worldwide.

This transformation is opening exciting new opportunities for any Rum business aiming to establish or expand a presence across the continent.

What is driving Europe's Rum revival?

Several powerful growth drivers are converging to create this momentum, underpinned by the trend towards premiumisation.

Europe now accounts for nearly half of global premium and super-premium Rum sales, reflecting a growing interest in provenance and craft spirits.

The continent’s flourishing cocktail scene is also fuelling demand, spanning both on-trade venues as well as off-trade channels to create multiple touchpoints for brand engagement.

And as consumers embrace innovation and mixing, we are seeing a growing demand for versatile styles such as white, spiced, dark and aged Rums. Interest in flavoured and spiced rums is also on the up, especially younger demographics.

Rising levels of disposable income, tourists returning from Caribbean holidays with a taste for the local spirit, and industry-wide investment in education and storytelling are also contributing to this perfect storm of growth and opportunity.

Join us on a whistlestop tour of the European market

Needless to say, the European landscape varies widely. The nuances of different markets are resulting in consumer preferences and growth patterns that vary from region to region. Let’s take a quick tour around the continent to examine these trends more closely.

Starting in Western Europe…

The United Kingdom

The overall UK market looks unlikely to hit growth forecasts. Even so, we are seeing one positive trend in the form of buoyant demand for premium, super premium and flavoured Rums with a flourishing start-up sector centred on London.

As customers increasingly seek out high quality and unique flavour profiles, those Rums perceived as serious sipping spirits are jostling for market share alongside more traditional choices such as whisky and cognac.

Flavoured Rums are also gaining significant traction as producers experiment with botanicals and local ingredients. At the same time, brands are addressing consumer concerns around ethical sourcing and production practices. It is also interesting to note that a growing number of start-ups are integrating local heritage and traditions into their storytelling.

Germany

Germany leads the charge as one of Europe's largest Rum markets, commanding around 15% of volumes in 2024 according to the IWSR.

A sustained cultural affinity between Germany and the traditional Rum-producing Caribbean regions continues to drive steady demand and open up opportunities for brands with authentic Caribbean heritage.

Popular public events are also playing a part, serving to increase brand awareness and consumer engagement. One such example is the annual German Rum Festival, which connects over 150 brands and 500 different rum bottlings to an audience comprising both enthusiasts and newcomers.

The German market is also shifting towards premium and craft Rums. As consumer preferences shift towards high-quality, artisanal spirits, unique flavour profiles and authentic craftsmanship, drinkers are willing to pay more for quality and exclusivity.

France

France represents yet another Rum powerhouse thanks to its strong cultural ties with Rum-producing French Caribbean islands such as Martinique and Guadeloupe.

These islands are home to the unique Rhum Agricole. Produced from fresh sugarcane juice and protected by AOC designation, Rhum Agricole is an attractive choice for drinkers who appreciate distinct flavour profiles, heritage and craftsmanship.

The concept of terroir is also a factor, with a growing number of craft distilleries focused on terroir and small-batch productions aimed at younger generations interested in authenticity, complexity and other Rum styles.

At the same time, many large, well known names in the dwindling wine industry are looking to diversify their portfolios by adding Rum to their long established line-ups of cognacs and brandies.

More experimental Rums are starting to appear in the form of flavoured and spiced varieties, and the results give rise for optimism. Yet by far the largest shift in the market is for premium and Gold Rums, with on-trade and retail both seeing an increase in demand.

Heading up to Northern Europe…

The Nordic countries are experiencing particularly interesting trends, with robust growth in the demand for aged, craft and prestige Rums.

As we are seeing elsewhere in the continent, purchase decisions are increasingly influenced by ethical sourcing and sustainable production, with Bonsucro- and Fairtrade-certified Rums increasingly becoming the new standard for conscious consumers.

The younger demographic prefers sweeter flavoured Rums – especially so in Sweden. Premium aged Rums, meanwhile, are gradually luring older drinkers away from their usual go-to whiskies.

That is why in the Nordics too, the focus remains on the aged, craft and prestige Rum segments.

Down into Southern Europe…

Welcome to Italy, Europe's fastest-growing Rum market. Here, a rich aperitivo culture places the emphasis on high-quality liqueurs and bitters. Today, innovative brands are increasingly using Rum as an essential base for liquors, a clear demonstration of the spirit’s evolution beyond traditional drinking patterns.

The White Rum segment is expected to be the highest contributor to growth, with White and Golden Rum segments collectively accounting for approximately 67.3% of market share. Notably, Spiced Rum and Dark Rum segments are also seeing significant growth rates.

And finally across to Eastern Europe

Czechia, Slovakia, Poland and the Baltic states… interest in Rum is growing all across Eastern Europe with the share of clear spirits such as vodka and gin falling as a consequence. It is interesting to note that Czechia alone accounts for almost a quarter of the Eastern European Rum market size.

While vodka remains dominant, Rum is clearly gaining traction - particularly the premium and flavoured varieties. This growth is being driven by rising disposable incomes and the desire for premium experiences we are seeing across the rest of the continent.

Even so, the premiumisation trend has fallen short of the pace initially envisaged due to economic and geopolitical pressures.

The rise of RTDs

As inflation might have squeezed the European market in 2024, one clear winner emerged. As shoppers turned their attention away from bar counters to supermarket aisles, the ready-to-drink rum cocktail soared in popularity, with a noticeable growth of premium brands specialising in RTDs, such as Moth and Served, capturing consumers looking for both convenience and quality.

The off-premise take-home market saw significant growth, especially through major retailers like Aldi, Lidl and Mercadonna in the German and Spanish markets. Germany's alco-pop regulations have also opened up a unique set of opportunities, with RTD cocktails above 10% ABV flying off the shelves. And this popularity shows no signs of waning, as consumption moves from home to on-trade venues like bars, clubs and festivals.

Why Europe represents an unmissable opportunity for your Rum

Market dynamics, shifts in drinking patterns, and mature infrastructure combine to make Europe an exceptionally attractive proposition for Rum businesses at every stage of growth.

- Consumer preferences are shifting decisively toward premium, craft, and diverse flavour profiles, creating fertile ground for differentiation and innovation.

This evolution means that brands with unique stories, authentic production methods or distinctive flavour profiles can find receptive audiences willing to pay premium prices for quality experiences.

- The strong growth in both retail and hospitality means brands can reach consumers in different places, helping them strengthen their market presence while being less dependent on just one type of occasion or audience.

- As key markets like Germany and the UK couple strong demand with an openness for innovation, they become ideal testing grounds for new products and market strategies.

- An expanding set of distribution channels, from the rising cocktail culture to online retail, provide additional entry points for ambitious Rum brands.

Perhaps most importantly, the European market rewards authenticity and quality. For brands that invest in genuine differentiation, this can pave the way for a powerful and sustainable competitive advantage.

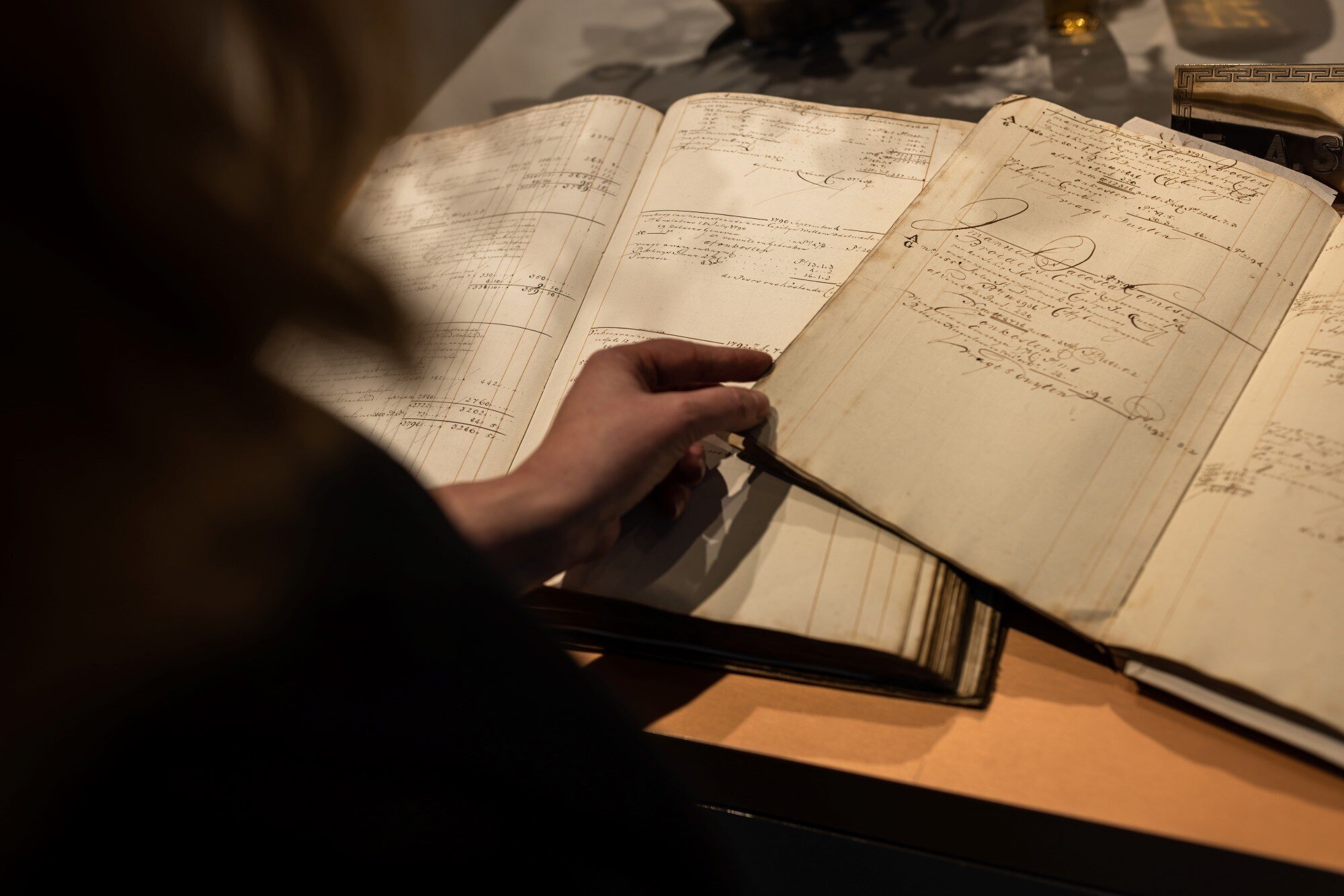

How E&A Scheer helps you to navigate the European market

The European Rum market opens exceptional opportunities for brands ready to engage with sophisticated, quality-focused consumers across diverse and growing markets.

As a global leader in sourcing, blending, and supplying Rum, E&A Scheer is uniquely positioned to support brands wishing to capitalise on these opportunities.

Our expertise in crafting blends that match local tastes ensures your brand resonates with target consumers across different European markets, whether aged profiles for premium segments or flavoured expressions for younger demographics.

We provide at-scale supply capabilities to support both retail and hospitality demand, backed by long-established partnerships across the value chain, from distilleries to logistics partners.

Needless to say, our robust quality assurance processes fully align with EU market requirements.

Try out our unique blending tool

Rum Blending Tool

Browse the latest resources & industry insights to learn more about our companies and the Rum world in general.